Federal Estate Tax Exemption 2025. With the increased exemption amount through 2025, certain lifetime gifting strategies can be implemented now, before the sunset, to reduce estate values and estate tax. In other words, giving more.

20, 2018, the irs clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to. If an individual gives more than the annual exclusion amount, the excess counts toward their lifetime estate and gift tax exemption, which.

Federal Estate Tax Exemption 2025 Images References :

Source: www.financialsamurai.com

Source: www.financialsamurai.com

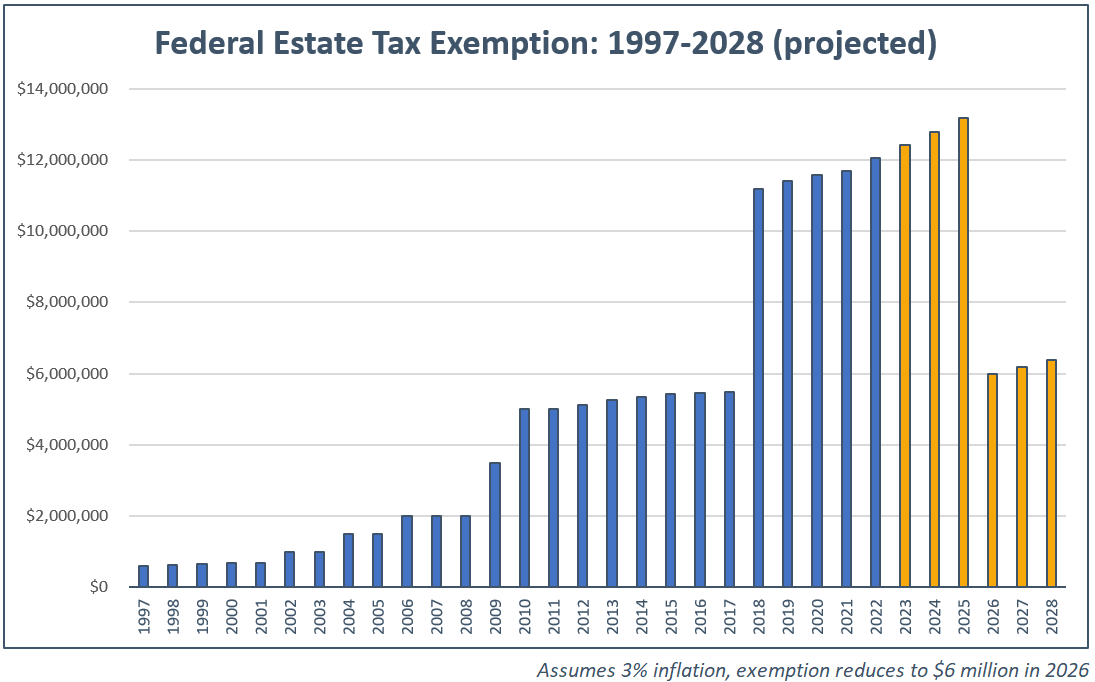

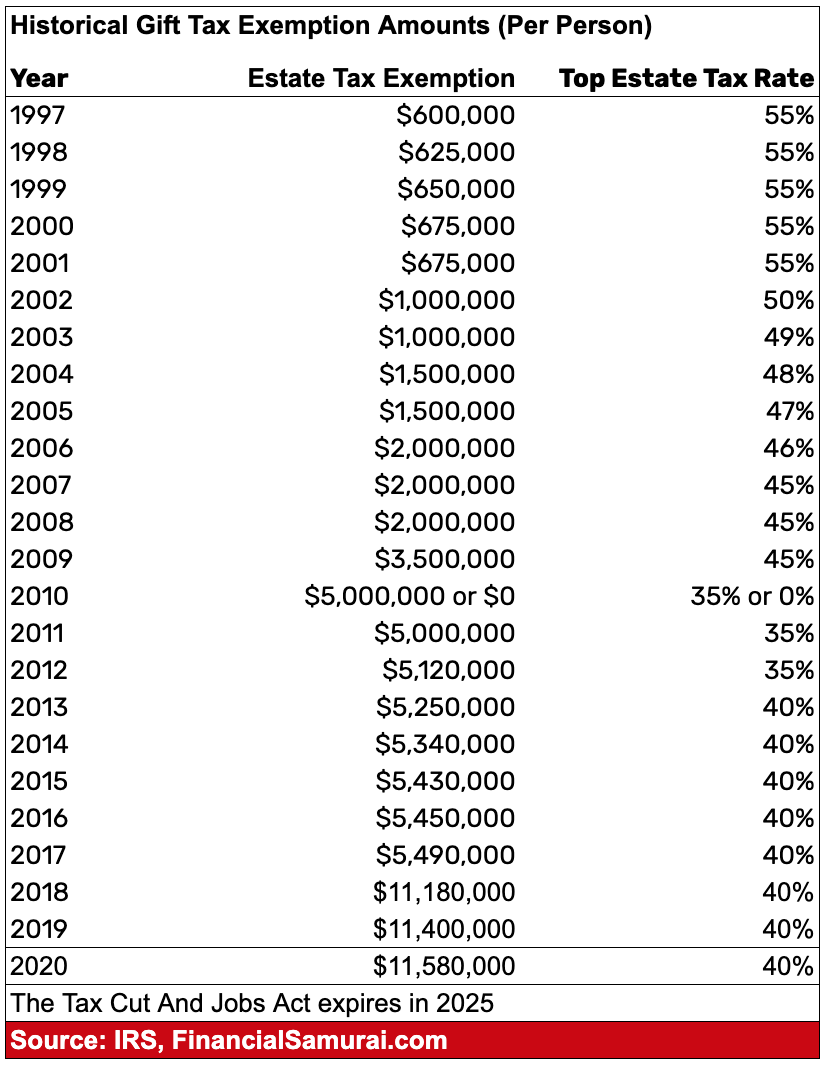

Historical Estate Tax Exemption Amounts And Tax Rates, The irs has announced that in 2025, the lifetime estate and gift tax exemption (the lifetime exemption) will rise to $13,990,000 (from $13,610,000);

Source: 2025and2026schoolcalendar.pages.dev

Source: 2025and2026schoolcalendar.pages.dev

The Federal Estate Tax Exemption 2025 And Beyond List of Disney, With the increased exemption amount through 2025, certain lifetime gifting strategies can be implemented now, before the sunset, to reduce estate values and estate tax.

Source: 2025and2026schoolcalendar.pages.dev

Source: 2025and2026schoolcalendar.pages.dev

The Federal Estate Tax Exemption 2025 And Beyond List of Disney, The federal estate tax exclusion amount is crucial—it’s the threshold below which estates aren’t taxed.

Source: wynnejillie.pages.dev

Source: wynnejillie.pages.dev

Estate Tax Exemption 2025 Paige Barbabra, Married couples can expect their exemption to be $27.98 million (up from $27.22 million last year).

Source: www.cplanning.com

Source: www.cplanning.com

Estate Tax Exemption Sunsetting After 2025 How It Affects Your, The federal lifetime estate and gift tax exemption will sunset after 2025.

Source: dollyvgabriellia.pages.dev

Source: dollyvgabriellia.pages.dev

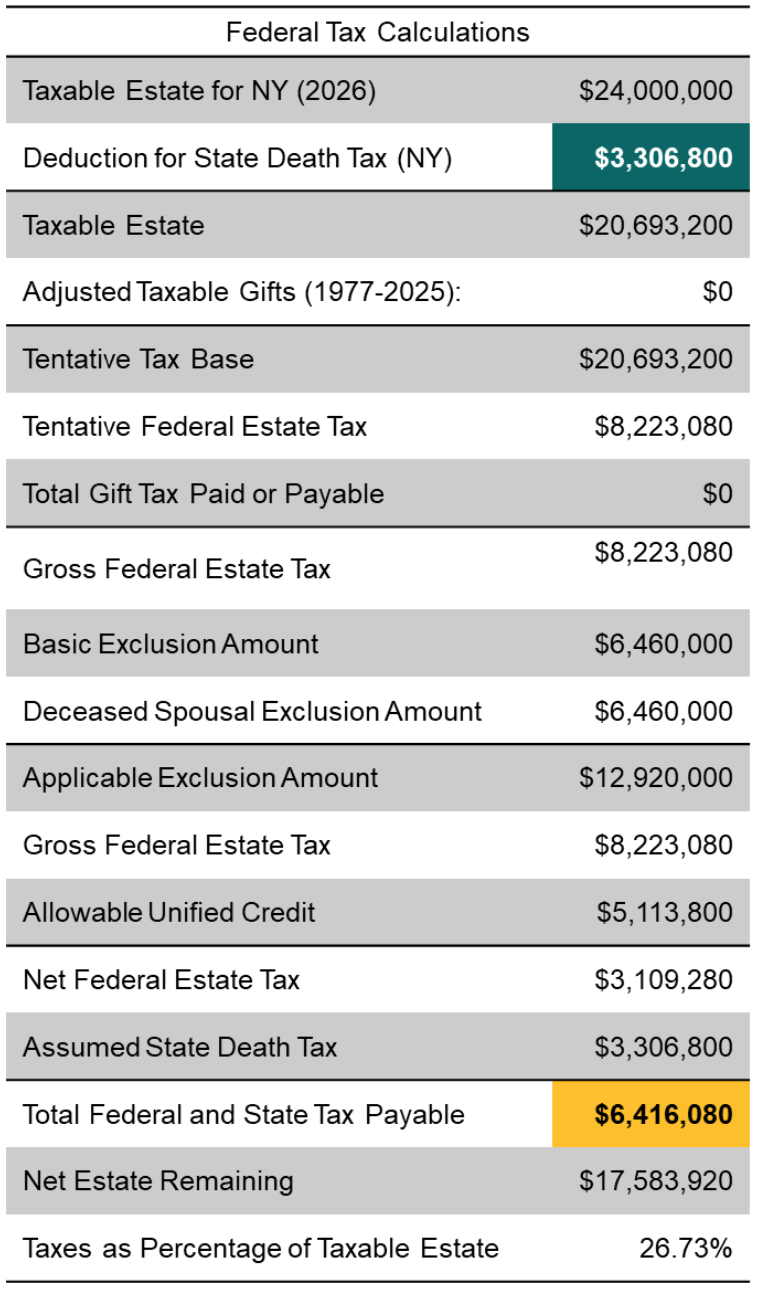

Estate Tax Exemption 2025 Married Couple Gabie Jocelyn, If congress does not act before the end of 2025, the exclusion amount (the amount that passes to heirs free of federal estate taxes) is estimated to revert to roughly $7 million.

Source: alterraadvisors.com

Source: alterraadvisors.com

Federal Estate Tax Exemption 2022 Making the Most of History’s Largest, The irs has announced that in 2025, the lifetime estate and gift tax exemption (the lifetime exemption) will rise to $13,990,000 (from $13,610,000);

Source: milvidlaw.com

Source: milvidlaw.com

IRS Announces 2025 Gift and Estate Tax Exemptions, In addition to the federal estate tax, with a top rate of 40 percent, 12 states and dc impose additional estate taxes, while six states levy inheritance taxes.

Source: legacygroupny.com

Source: legacygroupny.com

Estate Tax Exemption Changes Coming in 2026 Estate Planning, Married couples can expect their exemption to be $27.98 million (up from $27.22 million last year).

Source: annoraylarina.pages.dev

Source: annoraylarina.pages.dev

2024 Estate Tax Exemption Amount 2024 Aubrey Stephie, The “basic exclusion amount” rises to $13.99 million for 2025, up from $13.61 million in 2024, the agency.

2025