Ohio 529 Contribution Limit 2024 In India. You’ll find performance data, fees and expenses, and price history here. — each state sets its own maximum aggregate contribution limit for 529 plans, ranging from $235,000 to over $575,000.

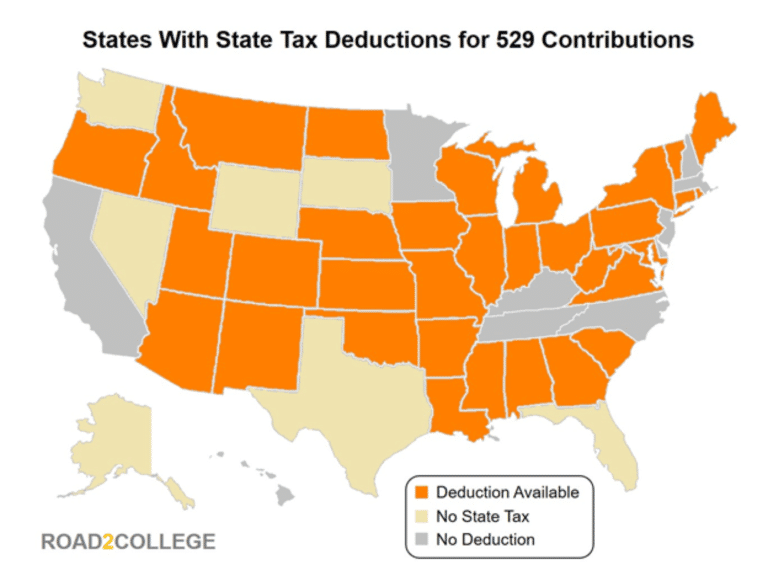

Ohio offers a state tax deduction for contributions to a 529 plan of up to $4,000 per year for any filing status. — nearly every state offers a 529 savings plan, but each sets a maximum contribution limit.

Ohio 529 Contribution Limit 2024 In India Images References :

Source: arielqgianina.pages.dev

Source: arielqgianina.pages.dev

529 Annual Contribution Limits 2024 Dianne Kerrie, You’ll find performance data, fees and expenses, and price history here.

Source: tovaqclemmie.pages.dev

Source: tovaqclemmie.pages.dev

529 Plan Contribution Limits 2024 Aggy Lonnie, View our faq list to learn about opening, managing and benefiting from this college savings.

Source: lesyaqmichaela.pages.dev

Source: lesyaqmichaela.pages.dev

529 Limits 2024 Elset Horatia, What’s the contribution limit for 529 plans in 2024?

Source: oreleewquinn.pages.dev

Source: oreleewquinn.pages.dev

Contribution Limit For 529 Plan 2024 Rosy, You’ll find performance data, fees and expenses, and price history here.

Source: mandakatalin.pages.dev

Source: mandakatalin.pages.dev

Ohio 529 Contribution Limits 2024 Vanya Jeanelle, In 2024, the annual 529 plan contribution limit rises to $18,000 per contributor.

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg) Source: www.investopedia.com

Source: www.investopedia.com

529 Plan Contribution Limits in 2024, — maximum 529 plan contribution limits.

Source: collegeadvantage.com

Source: collegeadvantage.com

Learn About Ohio 529 Plan CollegeAdvantage, — contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary.

Source: kimberlynwalvera.pages.dev

Source: kimberlynwalvera.pages.dev

Irs 529 Contribution Limits 2024 Rory Walliw, This deduction is limited to $4,000 per beneficiary per year.

Source: www.youtube.com

Source: www.youtube.com

529 Plan Contribution Limits Rise In 2023 YouTube, Ohio offers a state tax deduction for contributions to a 529 plan of up to $4,000 per year for any filing status.

Source: www.mybikescan.com

Source: www.mybikescan.com

2024 529 Contribution Limits What You Should Know MyBikeScan, — in 2024, individuals can gift up to $18,000 in a single 529 plan without those funds counting against the lifetime gift tax exemption amount.

2024