Tax Brackets 2024 Married Jointly California. The income tax calculator estimates the refund or potential owed amount on a federal tax return. Based on your annual taxable income and filing status, your tax.

The same as the federal income tax brackets, california has a. 2024 california and federal income tax brackets below is a quick reference table for california and federal income taxes for 2024.

It Is Mainly Intended For Residents Of The U.s.

Tax calculator is for 2023 tax year only.

Single Tax Brackets Generally Result In Higher Taxes When Compared With Taxpayers With The Same Income Filing As Married Filing Jointly Or Head Of Household.

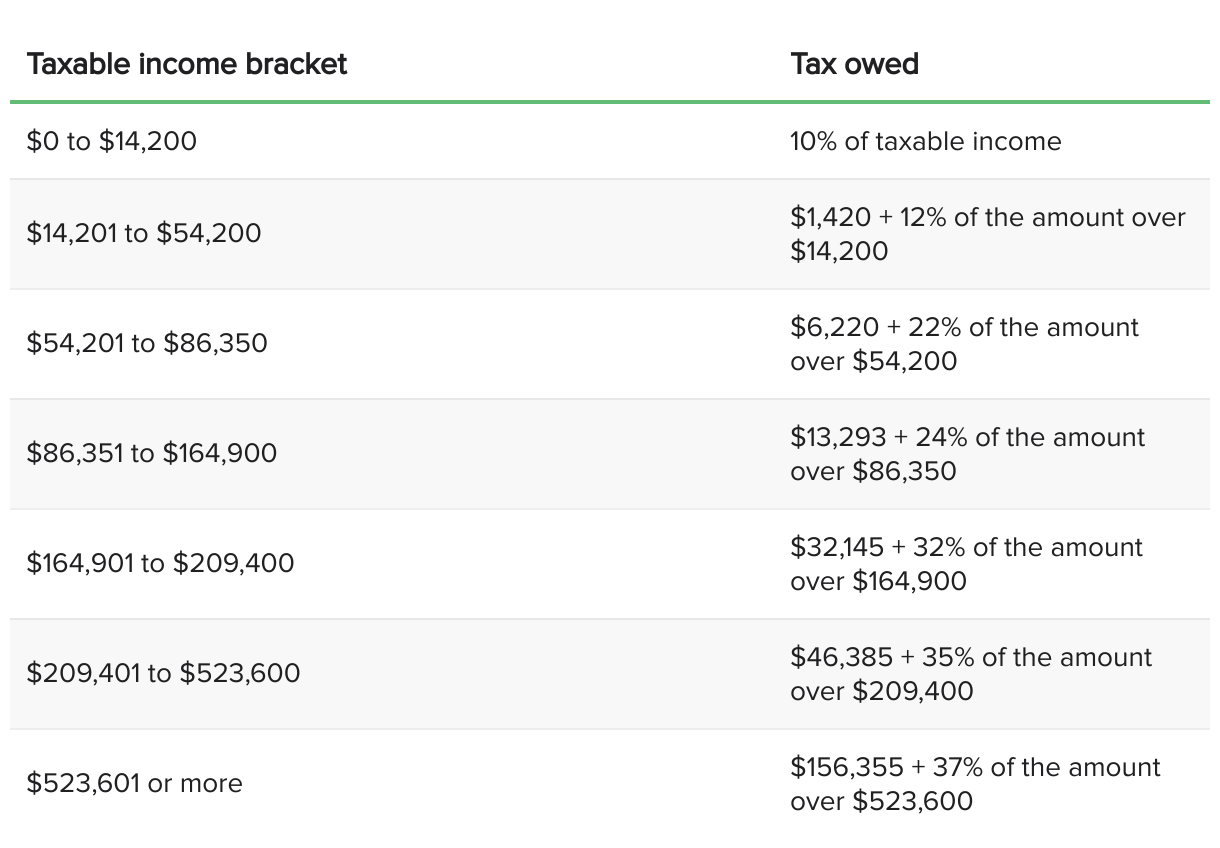

The federal income tax has seven tax rates in 2024:

Tax Brackets 2024 Married Jointly California Images References :

Source: nanceqsimonne.pages.dev

Source: nanceqsimonne.pages.dev

Tax Brackets 2024 California Married Elisa Helaine, The california standard deduction for 2023 tax returns filed in 2024 is $5,363 (single or married filing separately) and $10,726 (married filing jointly, qualifying widow/er or head of household. California income tax brackets and rates:

Source: charmainwluci.pages.dev

Source: charmainwluci.pages.dev

2024 California Tax Brackets Married Filing Jointly Amalea Blondell, The same as the federal income tax brackets, california has a. Quickly figure your 2023 tax by entering your filing status and income.

Source: leylaqlaraine.pages.dev

Source: leylaqlaraine.pages.dev

2024 Tax Brackets Married Jointly And Jointly Ray Leisha, So, for example, a married couple filing jointly will. Wondering how much to set aside for 1099 taxes?

Source: sapphirewrana.pages.dev

Source: sapphirewrana.pages.dev

Irs Brackets 2024 Married Jointly Lusa Nicoline, We show both the initial mandated federal withholding of 24% as. Note, the list of things not.

Source: cheriannewnada.pages.dev

Source: cheriannewnada.pages.dev

Tax Brackets 2024 Usa Married Filing Jointly Jessi Lucille, Married filing jointly is the filing type used by taxpayers. The top california income tax rate has been 13.3% for a decade, but effective on january 1, 2024, the new top rate is.

Source: korellawcorri.pages.dev

Source: korellawcorri.pages.dev

California Tax Brackets 2024 2024 Married Maxie Rebeca, Do not use the calculator for 540 2ez or. The top california income tax rate has been 13.3% for a decade, but effective on january 1, 2024, the new top rate is.

Source: bobbyeqestrella.pages.dev

Source: bobbyeqestrella.pages.dev

What Are The 2024 Tax Brackets For Married Filing Jointly Issi Charisse, We’ll show you how tax brackets impact freelancers, so you won’t get stuck with an oversized tax bill. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Source: pedfire.com

Source: pedfire.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments, The income tax calculator estimates the refund or potential owed amount on a federal tax return. The top california income tax rate has been 13.3% for a decade, but effective on january 1, 2024, the new top rate is.

Source: zoraqkathlin.pages.dev

Source: zoraqkathlin.pages.dev

2024 Tax Brackets Married Filing Separately Married Filing Adele Antonie, The california income tax has nine tax brackets. Single tax brackets generally result in higher taxes when compared with taxpayers with the same income filing as married filing jointly or head of household.

Source: rgwealth.com

Source: rgwealth.com

2024 Tax Code Changes Everything You Need To Know, Technically, tax brackets end at 12.3% and. This page has the latest california brackets and tax rates, plus a california income tax calculator.

In All, There Are Nine Official Income Tax Brackets In California, With Rates Ranging From As Low As 1% Up To 12.3%.

2024 california and federal income tax brackets below is a quick reference table for california and federal income taxes for 2024.

Married Filing Jointly Is The Filing Type Used By Taxpayers.

The federal income tax has seven tax rates in 2024:

Posted in 2025